Stonewood Financial Blog

Recent Articles

- Becky Swansburg

- February 13, 2026

It’s official: The IRS has opened the 2026 Tax Filing Season. Between now and April 15, nearly 164 million people will...

- Becky Swansburg

- January 30, 2026

What a rush!

- Becky Swansburg

- January 16, 2026

The government sure gets creative when it needs more revenue. And guess where that additional revenue often comes from?...

- Laura Deignan

- January 5, 2026

A New Book Clearly Outlines the Retirement Risks Coming from Washington - And How Savers Can Prepare

For decades, Americans were taught to save for retirement by deferring their taxes. 401(k)s and IRAs became the default...

Advisor Advice,

Legislative Risk,

Tax Risk,

Advisor Training,

Roth Done Right,

IRMAA,

Legacy Done Right

- Becky Swansburg

- December 19, 2025

This week, Jews around the world are celebrating Chanukah, the festival of lights.

- Neil Wilding

- December 5, 2025

There’s a good chance your clients have legacy funds just sitting in their IRAs.

- Neil Wilding

- November 19, 2025

They declared!

- Becky Swansburg

- November 7, 2025

The IRS has released its 2026 adjustments to tax brackets, deductions and exemptions.

- Tyler Randall

- October 24, 2025

Now more than ever, Roth conversions deserve to be a cornerstone of tax-efficient retirement planning. With everything...

- Becky Swansburg

- October 10, 2025

If paying taxes drives you to drink, you’re not alone. So it’s interesting to note the driest era in American history...

- Neil Wilding

- September 26, 2025

Here at Stonewood, we follow legislative developments closely. And this year, none has been more important to...

Practice Transformation,

Financial Advisor Marketing Tools,

Advisor Training,

Annuity Alpha,

Roth Done Right

- Tyler Randall

- September 12, 2025

Even as the summer sunshine fades, one strategy keeps its glow: Showing clients the value of an income annuity.

- Neil Wilding

- August 29, 2025

Let’s talk Inherited IRAs. After all, the majority of retirement money across America is sitting in tax-deferred...

- Martin Ruby

- August 15, 2025

It’s no secret that the retirement planning landscape has changed dramatically. Just a generation ago, savers could...

- Alec Stout

- August 8, 2025

Retirement plans can unravel from the inside, and not always because of market losses or tax hikes. One...

- Jessica Scott

- August 1, 2025

Lead generation has evolved. What once worked - cold calls, generic workshops, or broad digital ads - often doesn’t...

- Neil Wilding

- July 25, 2025

Roth conversions are a great way for savers to protect themselves against the risk of rising taxes. In fact, the...

- Becky Swansburg

- July 18, 2025

As our nation celebrated its independence this Fourth of July, President Trump signed the One Big Beautiful Bill into...

- Becky Swansburg

- July 11, 2025

The National Mall wasn’t the only place to see fireworks in Washington this Fourth of July. Over at the White House,...

- Tyler Randall

- June 27, 2025

June brings sunshine, heat, vacations, and celebrating the end of school and the beginning of summer (feel free to...

- Martin Ruby

- June 20, 2025

Today’s retirement landscape is fundamentally different from what most of us took for granted just one generation ago....

- Tyler Randall

- June 13, 2025

Are Roth Conversions a good idea in today’s tax and market environment?

- Neil Wilding

- June 6, 2025

This week, nearly 600 independent financial advisors joined Stonewood for our Virtual Innovate Summit conference.

- Laura Deignan

- May 30, 2025

Some training events just fill in the gaps. Others shift your entire approach.

- Becky Swansburg

- May 23, 2025

Hundreds of advisors took to Capitol Hill this week as part of NAIFA’s annual Congressional Conference.

Practice Transformation,

Retirement Tax Bill,

Financial Advisor Marketing Tools,

Advisor Training,

Annuity Alpha,

Roth Done Right

- Tyler Randall

- May 16, 2025

What makes a client take action? It’s not just trust—it’s trust based on understanding.

- Becky Swansburg

- May 9, 2025

It’s May. The flowers are blooming. Spring is in the air.

- Matthew Sieja

- May 2, 2025

On the eve of the first Saturday in May, all eyes turn to Churchill Downs for "The Most Exciting Two Minutes in...

- Becky Swansburg

- April 25, 2025

As every successful advisor knows, today’s retirement planning landscape is changing - fast.

- Neil Wilding

- April 18, 2025

If you’ve followed our newsletter for a while, you know I write often about Roth Conversions. Advisors always want to...

- Laura Deignan

- April 11, 2025

Today’s savers face numerous risks as they prepare for a successful retirement - from tax and legislative risk to...

- Becky Swansburg

- April 4, 2025

It’s that time of year when everyone seems to be on vacation. Spring break is here, and families are headed to the...

- Laura Deignan

- March 28, 2025

Leadership in Washington has been busy debating bills and policies that could significantly impact U.S. savers. So,...

- Laura Deignan

- March 21, 2025

As the seasons change and spring approaches, many people take the opportunity to deep clean their homes, declutter...

- Neil Wilding

- March 14, 2025

Many advisors are working with clients to consider Roth Conversions. And usually, the main driver of those discussions...

- Becky Swansburg

- March 7, 2025

I love government reports.

- Tyler Randall

- February 28, 2025

Is there a "right" way to approach Roth conversions? Here at Stonewood, the answer is “yes” - and we’ve developed the...

- Laura Deignan

- February 21, 2025

This week at Innovate Summit we brought the industry's brightest minds together for two days of powerful insights,...

- Laura Deignan

- February 14, 2025

Next week, Stonewood Financial is welcoming over 100 of the nation’s top independent financial advisors to Louisville,...

- Becky Swansburg

- February 7, 2025

If your clients are like most American savers, they’ve used tax-deferred accounts to save for retirement. And if...

- Neil Wilding

- January 31, 2025

Roth conversions are gaining in popularity, and with the debate over extending the Tax Cuts & Jobs Act in full swing in...

- Becky Swansburg

- January 24, 2025

With President Trump’s inauguration this week, all eyes are on Washington to see what policies and priorities the new...

- Becky Swansburg

- January 24, 2025

IRMAA is suddenly the “it” topic for advisor seminars, webinars, and more. For the uninitiated, IRMAA, or the...

- Edward Smith

- January 17, 2025

I know how many marketing emails and postcards we receive here at Stonewood Financial from other companies advertising...

- Martin Ruby

- January 3, 2025

When I founded Stonewood Financial over 20 years ago, I had no idea the industry force it would become. At the time, we...

- Laura Deignan

- December 20, 2024

The holiday season is a time of celebration, connection, and rest. However, it can also bring a noticeable lull in...

- Becky Swansburg

- December 13, 2024

If you’ve been following our blog this year, you’ve noticed I’ve been sharing some of my favorite message frames....

- Edward Smith

- December 6, 2024

At this point, most people are familiar with the term “FinTech” or Financial Technology and its massive presence in our...

- Jessica Scott

- November 22, 2024

So, you’ve set up lead scoring in your CRM and have a prioritized list of prospects. Now what? The next step is...

- Neil Wilding

- November 15, 2024

Is a Roth Conversion really worth it? It's a question I encounter almost daily—whether on the internet, on YouTube, in...

- Becky Swansburg

- November 8, 2024

The voters have spoken, and we’ve elected a new President and Congress.

- Alec Stout

- November 1, 2024

“An investment in knowledge pays the best interest.” – Benjamin Franklin In retirement income planning, continuous...

- Becky Swansburg

- October 25, 2024

We’re now less than two weeks away from the election. Which means… You have two weeks to leverage America's attention...

- Jessica Scott

- October 18, 2024

If you’re a financial advisor aiming to grow your practice, you’ve likely come across the term "lead scoring." But what...

- Becky Swansburg

- October 11, 2024

Artificial intelligence tools - like OpenAI’s ChatGPT and Google’s NotebookLM - will increasingly impact the way...

- Laura Deignan

- October 4, 2024

Are you finding leads online? Are you building trust with your clients and prospects on the platforms where they’re...

- Becky Swansburg

- September 27, 2024

The election is almost here, and it could have a BIG impact on our clients and their retirement assets. Will the Trump...

- Laura Deignan

- September 20, 2024

As we approach a pivotal election, financial advisors must remain vigilant about the legislative risks that could...

- Becky Swansburg

- September 13, 2024

September brings autumn temperatures, back-to-school vibes, and the return of the pumpkin spice latte. But September...

- Neil Wilding

- September 6, 2024

It’s Legislative Risk Awareness Month, and today I want to share one of the clearest examples of Legislative Risk many...

- Becky Swansburg

- August 30, 2024

September, it seems, is a month designated for celebrations and observations.

- Laura Deignan

- August 23, 2024

In an era where digital transformation is not just a trend but a necessity, financial advisors find themselves at a...

- Becky Swansburg

- August 16, 2024

Pop Quiz: What’s a big risk of retirement that doesn’t matter much while you’re saving… but can matter a LOT once...

- Neil Wilding

- August 12, 2024

When you and your clients think about annuities, what comes to mind?

- Jessica Scott

- August 1, 2024

Where do you turn for answers? For most of us, it’s Google or similar search engines. A prospective client’s journey to...

- Laura Deignan

- July 26, 2024

The financial services industry isn't a one-size-fits-all game. Different age groups have distinct financial goals,...

- Neil Wilding

- July 19, 2024

Advisors who help their clients mitigate tax and legislative risk in retirement naturally spend a lot of time helping...

- Becky Swansburg

- July 12, 2024

Believe it or not, our government is fairly transparent when it comes to its own spending - and the impact it could...

- Becky Swansburg

- June 28, 2024

It’s summertime, which means many of us are gearing up to participate in that great American tradition: Road Trips....

- Delphine Evans

- June 20, 2024

Growing your practice requires generating leads, and for many advisors that means live prospecting events. But as...

- Becky Swansburg

- June 14, 2024

In a way, taxes are the final frontier of retirement planning. As an industry, financial advisors have helped U.S....

- Laura Deignan

- June 7, 2024

As Elliot Masie said, "We need to bring learning to people instead of people to learning." That's exactly what we did...

- Becky Swansburg

- May 31, 2024

Unless you’ve been living in a cave, you know there’s a big election coming this November. (And even if you’ve been...

- Becky Swansburg

- May 24, 2024

Good financial advisors spend a good deal of their time helping clients understand - and address - the risks coming...

- Neil Wilding

- May 17, 2024

Sometimes, 1 + 1 = 3. Not mathematically, of course. But sometimes, when you add things together, the sum is far more...

- Martin Ruby

- May 10, 2024

Last month, the U.S. Department of Labor finalized the much-discussed Fiduciary Rule for retirement plans. The new...

- Becky Swansburg

- May 3, 2024

On Saturday, two dozen 3-year-old thoroughbreds will trot to the starting gate for the 150th running of the Kentucky...

- Edward Smith

- April 26, 2024

As financial professionals, one of our responsibilities is to “inflate the balloon of urgency” – motivate clients to...

- Becky Swansburg

- April 19, 2024

“How long does my money have to last?” Every financial advisor has been asked this question. In fact, it’s one of the...

- Becky Swansburg

- April 12, 2024

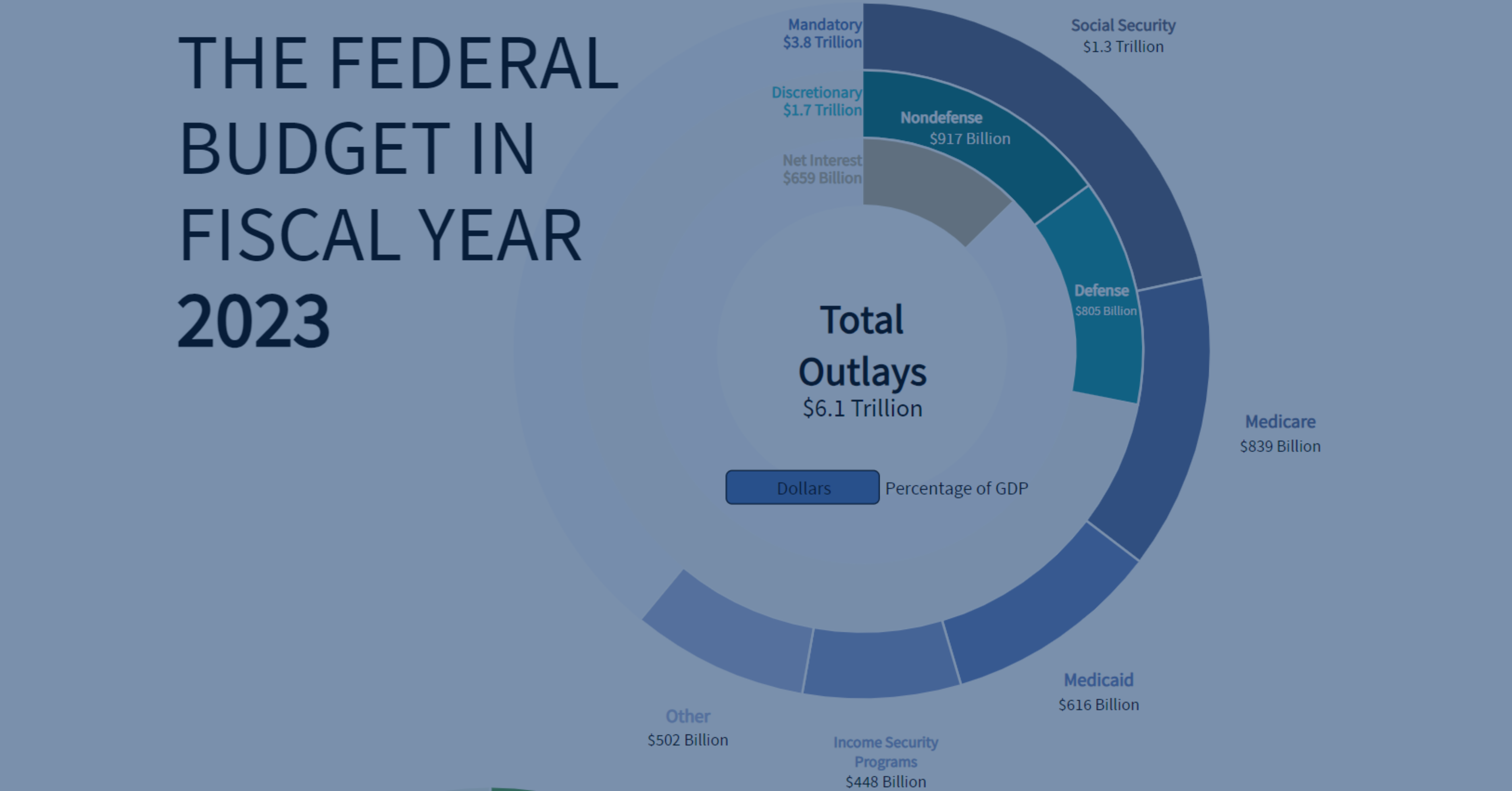

Reading over the Congressional Budget Office (CBO) report on FY2023 revenue and spending, I couldn’t help but think of...

- Becky Swansburg

- April 5, 2024

If you’re in the financial services business, it’s impossible to avoid people asking about Dave Ramsey. Dave Ramsey is...

- Neil Wilding

- March 29, 2024

In December, I wrote about Estate Planning being the next big topic in Advisor Growth. As the calendar turned to 2024,...

- Becky Swansburg

- March 22, 2024

Estate planning is one of 2024’s hottest seminar strategies for financial advisors. You don’t have to take my word for...

- Becky Swansburg

- March 15, 2024

Last week, President Biden delivered his State of the Union Address to Congress and the American people. So this week,...

- Laura Deignan

- March 8, 2024

Here at Stonewood Financial, our goal is to help advisors have the best year ever in their practices. And last week,...

- Becky Swansburg

- March 1, 2024

100 advisors walk into a hotel ballroom. No, it’s not the start of a joke. It’s the start of Stonewood Financial’s...

- Edward Smith

- February 23, 2024

In my experience, football coaches seem to have the funniest and most memorable sayings that never leave your brain. I...

- Becky Swansburg

- February 16, 2024

If you’ve followed this blog (or ever heard me speak), you undoubtedly know I’m a big fan of message frames. Message...

- Becky Swansburg

- February 9, 2024

As CJ Cregg, fictional White House Press Secretary on the hit TV show West Wing, once said: “Everybody’s stupid in an...

- Becky Swansburg

- February 2, 2024

I’m a big fan of message frames.

- Becky Swansburg

- January 26, 2024

When it comes to your clients and their retirement: Does it matter who wins November’s election? The answer is yes… and...

- Laura Deignan

- January 19, 2024

We’re living in a digital age. Even older clients are often consuming information and making decisions online - so...

- Neil Wilding

- January 12, 2024

Here we go again with the DOL and the fiduciary standards talk. As legislation continues to be discussed, let’s take a...

- Becky Swansburg

- January 5, 2024

It’s January. Marketing plans are being implemented. Seminars are being scheduled. Social media posts are being...

- Alec Stout

- December 22, 2023

Here at Stonewood, our passion is helping growth-minded advisors have their best year ever. So as we wind down 2023,...

- Neil Wilding

- December 15, 2023

When it comes to group marketing, successful advisors are always evolving one of two things: either the content they’re...

- Becky Swansburg

- December 7, 2023

Where are taxes headed - and how will it impact American savers? That’s a question that should be on every financial...

- Becky Swansburg

- December 1, 2023

The AI revolution may still be a ways off, but today’s initial crop of artificial intelligence tools can give financial...

- Neil Wilding

- November 17, 2023

I believe tax drag is real. I believe tax drag can cause losses in client portfolios. Thus, I believe advisors need to...

- Neil Wilding

- November 10, 2023

At some point, most of us have run a client’s annuity illustration and thought: I wonder what the capital markets would...

- Becky Swansburg

- November 3, 2023

If you’ve turned on the news lately (or read the paper… or looked at social media… or talked to practically anyone),...

- Neil Wilding

- October 20, 2023

The world of financial advice is filled with different business models. But whether you’re a fee-only advisor, a...

- Becky Swansburg

- October 13, 2023

The best independent financial practices are really small businesses at heart. We have big ideas and need to achieve...

- Becky Swansburg

- October 6, 2023

Did you find this article by googling “risk tolerance questionnaire”? If so, you were probably also greeted with dozens...

- Becky Swansburg

- September 29, 2023

Marketing to High-Net-Worth Individuals High-net-worth savers are in high demand among growth-minded advisors. Who...

- Becky Swansburg

- September 22, 2023

Let’s talk about content marketing. If you’re a growth-minded advisor, content marketing is key. In fact, it might...

- Becky Swansburg

- September 15, 2023

Do you have all the clients you could ever want or need? Of course not. Chances are, as an advisor, you split your time...

- Becky Swansburg

- September 8, 2023

Building Your Brand When it comes to financial advisor marketing, “branding” use to mean a good practice name, a nice...

- Becky Swansburg

- July 26, 2023

Tax Risk. Legislative Risk. What the heck is the difference? As things stay hot in Washington, I’m getting asked this...

- Neil Wilding

- October 3, 2022

Have you signed up for Stonewood's new Retirement Tax Bill program? Advisors like you are using it to prospect and...

- Becky Swansburg

- July 28, 2022

Remember David Letterman's Top 10 Lists? Today's blog post is a throwback to the glory days of the Late Show. We're...

- Neil Wilding

- June 28, 2022

One of the most gratifying parts of my job is hearing from advisors who are hitting it out of the ballpark with...

- Abigail Harrison

- May 24, 2022

Our recent Innovate IUL conference brought the industry's brightest minds to Louisville, Kentucky, for two days of...

- Neil Wilding

- April 22, 2022

You asked, and we answered. For several years, advisors like you have been asking us to create a lead-generation tool...

- Becky Swansburg

- December 22, 2021

As we wrap up the year here at Stonewood, we're celebrating our members' triumphs and looking ahead to a successful...

- Becky Swansburg

- November 29, 2021

In November, advisors from across the country gathered to learn at Stonewood's inaugural Innovate IUL conference in...

- Neil Wilding

- October 26, 2021

Every news item out of Washington seems to include details of a new or expanded tax. And generally, American savers...

- Becky Swansburg

- September 28, 2021

As financial professionals, we work hard to limit our clients’ exposure to risk in retirement.

- Becky Swansburg

- August 27, 2021

We've had an incredible response to our newest book - from advisors and clients alike. So why did we write it? And what...

- Martin Ruby

- April 2, 2020

It doesn’t take an actuary to know today’s market is in a volatile tumble. The social distancing protocol of the...

- Martin Ruby

- February 6, 2020

Today's IUL is very different - in design and use - from many of the UL products of the past. But a recent Wall Street...

- Martin Ruby

- February 6, 2020

I’m sure you run across clients who are true followers of Dave Ramsey. These clients are committed to getting debt-free...

- Martin Ruby

- January 24, 2018

In December, Congress passed a bill that could transform your practice in 2018 and beyond. I’m talking, of course,...

- Martin Ruby

- December 14, 2017

There’s been a lot of chatter lately (particularly from whole life producers) about the effectiveness of AG 49. Most of...

- Neil Wilding

- November 10, 2017

We bet it’s the most common objection you hear: IUL is an expensive way to save. You’ll hear it from prospects who did...

- Neil Wilding

- October 23, 2017

Nearly all Americans believe a myth. Every time savers look at their IRAs, they take part in the Great American Savings...

- Neil Wilding

- October 23, 2017

We all agree financial professionals should get paid for their work. But our industry is torn over how we get paid....

Subscribe to our blog here

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

%20The%20Answer%20is%20Yes...%20And%20No..png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

-1.png)

.png)

.png)

.png)