A Magic Ball on Taxes?

Where are taxes headed - and how will it impact American savers?

That’s a question that should be on every financial advisor’s mind. If only we had a magic ball to predict the future…

But the truth is, we don’t need a magic ball to help our clients understand the risk of rising taxes - and take action to protect themselves.

Predicting future tax rates is a challenging task. This is especially true for clients who have saved all or the majority of their retirement funds in tax-deferred vehicles. Because these clients have agreed to pay taxes on their retirement funds in the future, any changes to tax levels can impact the amount of retirement income they get to keep, versus the amount that will be sent to the IRS in the form of taxes.

And because our clients want to live long lives in retirement, we have to help them plan for future tax changes - not just over the next few years, but over the next 10, 20 or for some clients even 30 years in retirement.

What's the Risk? Higher Taxes.

The biggest risk to your clients who have saved in IRAs and 401(k)s - and therefore the risk we need to help them address - is the risk that taxes will be higher in the future than they planned. This could leave them with less spendable funds in retirement, potentially upending their income plans.

So what are the chances of taxes going up for your clients in retirement? Is it worth their (and your) time to prepare against this risk?

My answer is a resounding “YES.” Here’s why.

The Case for Higher Taxes

Many experts - myself included - believe that taxes on American savers will rise in the years and decades to come.

I started my career in Washington, D.C. working in the White House and on Capitol Hill. Because of my background, I still follow our government agencies pretty closely - especially as they put out data relevant to taxes and saving.

Earlier this year, the CBO put out their annual report on federal revenue and spending for fiscal year 2022. And when you crunch the data from that report, the case for higher taxes becomes pretty clear.

In FY 2022, the U.S. government took in $4.9 trillion in revenue. The largest source of revenue was individual income taxes, which generated $2.6 trillion.

$4.9 trillion sounds like a lot of money… until you evaluate government outlays and expenditures.

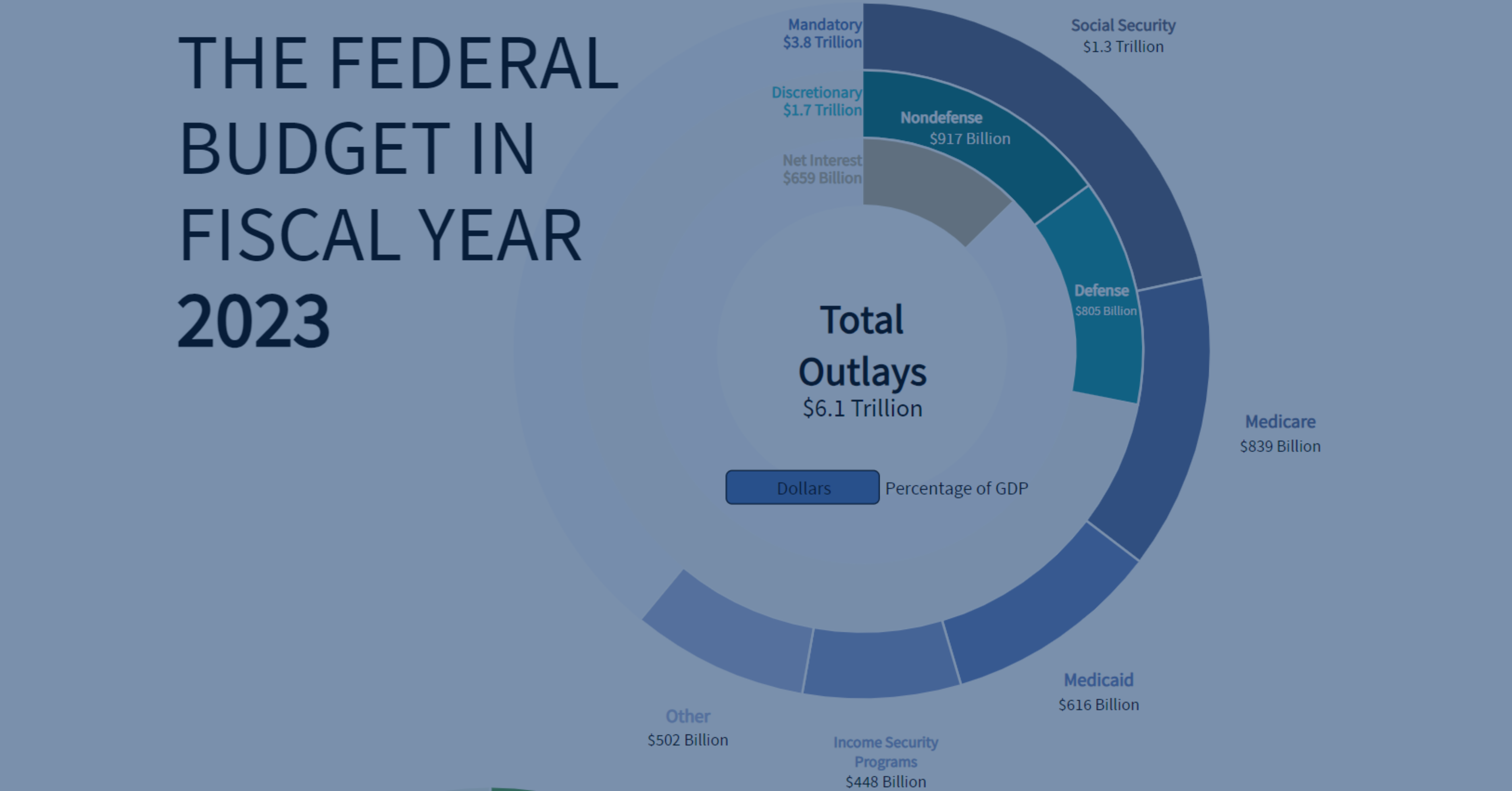

First, let’s look at mandatory spending, which is spending the government is required to distribute by existing law. Mandatory spending is primarily made up of government benefits - things like Social Security payments and Medicare expenditures. Congress doesn’t really have control over these expenditures - they are simply our government’s obligations under current law.

In FY 2022, our government spent $4.1 trillion on mandatory spending.

But that’s not quite a complete number. The other piece of federal spending Congress can’t control is the money America spends servicing our debt. Because interest rates are high right now, the government is paying its debt service at a higher rate. In FY 2022, that amounted to around $0.5 trillion.

When you add those numbers together, total non-discretionary spending was around $4.6 trillion.

So our government took in $4.9 trillion and spent $4.6 trillion BEFORE CONGRESS EVEN GOT INVOLVED.

Non-discretionary spending takes up almost all of our government’s revenue.

Of course, Congress did meet. And they passed appropriation bills that allocated discretionary spending.

Discretionary spending is the spending Congress allocates to government agencies and programs - it’s how we fund things like our military and the Department of Education. In FY 2022, our government spent $1.7 trillion on discretionary spending.

So, the total government revenue in FY 2022 was $4.9 trillion.

Total government spending in FY 2022 was $6.3 trillion.

See the problem?

There’s a $1.4 trillion gap between the revenue our government brings in and the revenue it sends out.

The Path to Higher Taxes

So long term, why does this lead to higher taxes for our clients?

Our government has a $1.4 trillion problem. And it really only has three ways to fix it.

First, the government could reduce mandatory spending.

This would be hard to do based on demographics alone.

America has an aging population. The growth in Americans age 65+ rose between the 2010 census and the 2020 census at the fastest rate since the 1890s. A full $2 trillion of mandatory spending is used for Social Security and Medicare alone. So with more seniors requiring more benefits - and the politically distasteful option of cutting benefits unlikely - this is a hard area of spending for our government to rein in.

Second, the government could reduce discretionary spending. After all, Congress could just quit passing legislation that is so expensive to enact.

I can sense you laughing at your desk as you read that last line. In the past few years, we have seen Congress debate trillions of dollars in NEW spending - not discuss measures to reduce spending.

Which brings us to the third option available to our government: Raise more revenue.

And this is why I believe we are entering into a rising tax environment for American savers.

The current federal debt has now climbed beyond $33 trillion. We can not sustain debt accumulation at this rate or this level. So the government is going to have to find ways to increase tax revenue to support its spending levels.

Help Your Client's Tax Action Now

If your clients have primarily focused on income planning for retirement, they’ve only done half the work. It’s time to complete their retirement approach with tax planning, too. After all, income planning is about how much money they’ll have in retirement. Tax planning is about how much of that income they’ll get to keep and spend.

Heading into 2024, tax diversification will be a critical piece of many savers’ retirement approaches. It will be important for Americans - especially higher-net-worth Americans - to have funds not only saved in tax-deferred accounts, but also in Roth accounts, IULs and other tax-free vehicles

Successful advisors will be the ones who help their clients and prospects identify tax risk, quantify tax risk, and address tax risk.

So where to start? Here are two Stonewood Financial resources that can help:

| Help prospects and clients quantify their potential retirement taxes using the Retirement Tax Bill lead program and software.

| Download this white paper I wrote on 5 Ways Taxes Could Rise For Your Clients to make sure you understand all the tax risks your clients may face - and what to do about them.

| Download this white paper I wrote on 5 Ways Taxes Could Rise For Your Clients to make sure you understand all the tax risks your clients may face - and what to do about them.

When it comes to taxes, it would be nice to have a magic ball predicting the future.

But we don’t need magic to help our clients protect their retirement approach from the risk of rising taxes - we just need education and solid strategies to address it.