Stonewood Financial Blog

Recent Articles

- Becky Swansburg

- February 13, 2026

It’s official: The IRS has opened the 2026 Tax Filing Season. Between now and April 15, nearly 164 million people will...

- Becky Swansburg

- January 30, 2026

What a rush!

- Becky Swansburg

- January 16, 2026

The government sure gets creative when it needs more revenue. And guess where that additional revenue often comes from?...

- Laura Deignan

- January 5, 2026

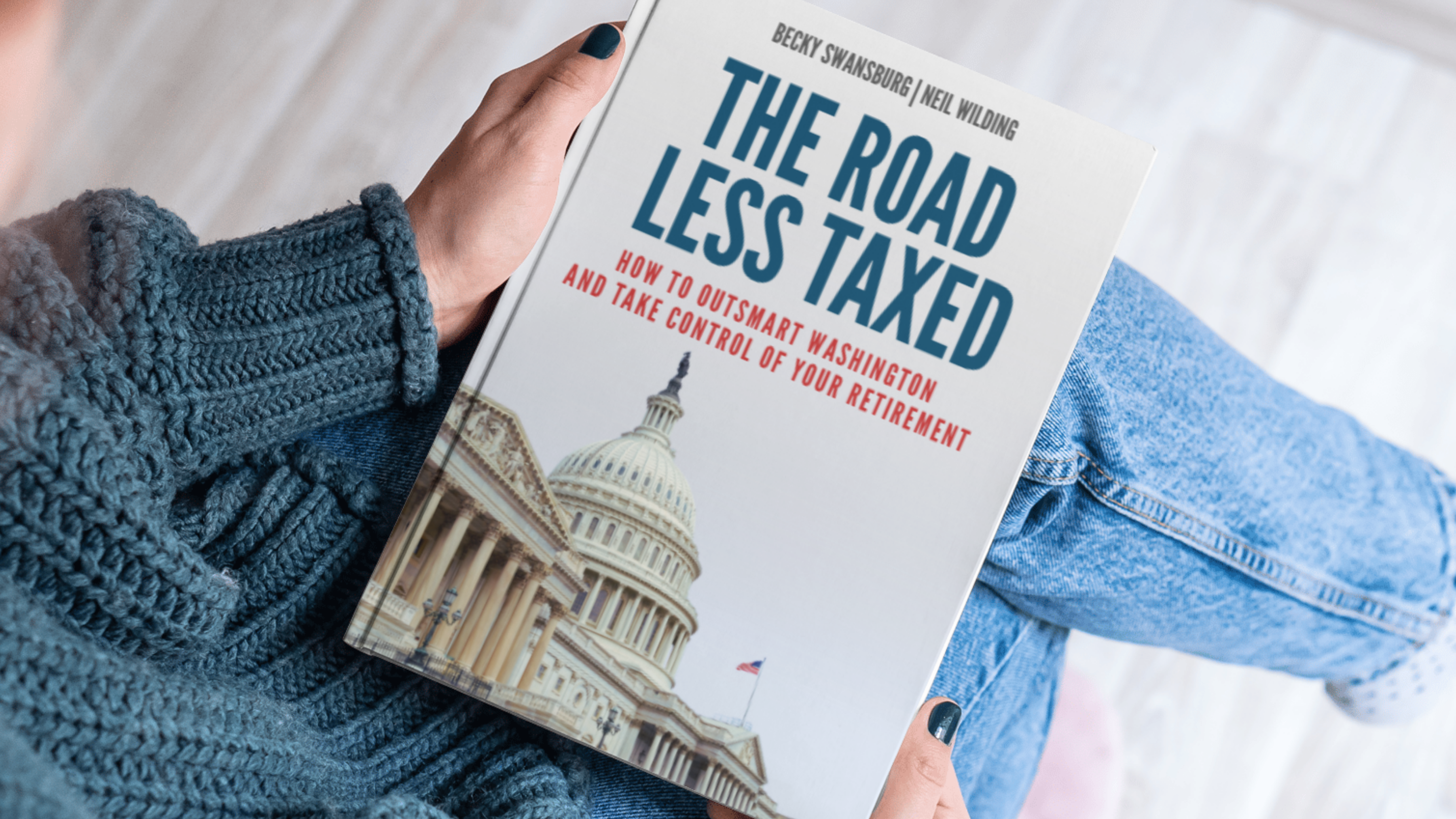

A New Book Clearly Outlines the Retirement Risks Coming from Washington - And How Savers Can Prepare

For decades, Americans were taught to save for retirement by deferring their taxes. 401(k)s and IRAs became the default...

Advisor Advice,

Legislative Risk,

Tax Risk,

Advisor Training,

Roth Done Right,

IRMAA,

Legacy Done Right

- Becky Swansburg

- December 19, 2025

This week, Jews around the world are celebrating Chanukah, the festival of lights.

- Neil Wilding

- December 5, 2025

There’s a good chance your clients have legacy funds just sitting in their IRAs.

- Becky Swansburg

- November 7, 2025

The IRS has released its 2026 adjustments to tax brackets, deductions and exemptions.

- Becky Swansburg

- October 10, 2025

If paying taxes drives you to drink, you’re not alone. So it’s interesting to note the driest era in American history...

- Alec Stout

- August 8, 2025

Retirement plans can unravel from the inside, and not always because of market losses or tax hikes. One...

- Becky Swansburg

- July 18, 2025

As our nation celebrated its independence this Fourth of July, President Trump signed the One Big Beautiful Bill into...

Subscribe to our blog here

.png)

.png)

.png)