Will the 2024 Election Impact Your Clients (and their Retirement)? The Answer is Yes… And No.

%20The%20Answer%20is%20Yes...%20And%20No..png)

When it comes to your clients and their retirement: Does it matter who wins November’s election?

The answer is yes… and no.

Let me explain.

When I worked in the White House and on Capitol Hill, I noticed there were two distinct ways I had to evaluate proposed legislation. I use these same two lenses to evaluate elections today.

-

First, the near-term impact: What specific legislation might the next Congress and President pass that could impact U.S. savers, IRAs and 401(k)s, estate taxes, and more?

-

Second, the long-term impact: What do the priorities of the incoming administration mean for America’s economic, tax and debt environment in the decades to come?

Where the Election Matters Most: Short-term Impact on U.S. Savers

If you’ve been following the news from Washington over the past 24+ months, you’ve undoubtedly noticed a shift in the attitude around retirement savings, particularly for higher-net-worth savers.

Once upon a time, saving for retirement was the responsible thing to do. You put a little away in a 401(k) or IRA each month, and over the years, you built a nice nest egg to support yourself in retirement. Responsible.

But in recent years, we’ve seen that attitude change. Suddenly, Washington feels that if a saver’s retirement account grows too large, they’re being greedy and should be penalized.

I first noticed this shift during the debate over the Build Back Better legislation House Democrats introduced in 2021. The spending bill - originally introduced with a $3.5 trillion price tag - also included nearly $2.9 trillion in new taxes to offset spending provisions.

Surprisingly, many of these new tax provisions were aimed at retirement accounts.

The original bill included new Required Minimum Distributions (RMDs) for retirement assets that grew “too large.” The House Ways and Means Committee fact sheet explained this was “To avoid subsidizing retirement savings once account balances reach very high levels…”

But the push to penalize successful savers didn’t end there.

Last year, when President Biden introduced his 2024 budget, he commented that “Tax breaks for retirement savings are supposed to help middle-class workers put a little aside for the future.” But, he noted, they were now being abused by wealthier Americans.

The President is rewriting history. IRAs were created by the Employee Retirement Income Security Act of 1974. Nowhere in that legislation does it say tax-deferred savings is only for middle-class workers. IRAs were a way to encourage all Americans to save for the future.

But regardless of the origins of tax-deferred saving, one thing is clear: retirement accounts for wealthier Americans seem to have a target on their back.

The outcome of November’s election could impact whether we’ll see more legislation attacking large-balance IRAs and 401(k)s. If Democrats control the White House and at least one branch of Congress, there’s a good chance these efforts continue.

Where the Election Doesn’t Much Matter: Long-term Impact on U.S. Savers

Of course, politics is only one factor in determining U.S. public policy.

Other forces – demographic, economic, and financial – can have an equal, if not greater, impact on policies impacting U.S. savers.

This is especially acute for Americans who have saved all or the majority of their retirement assets in tax-deferred vehicles, like 401(k)s and IRAs. These savers have made a bet that their taxes will be lower in retirement than they are today. But how likely is that to be true?

As I wrote in a blog post late last year, the Congressional Budget Office (CBO) puts out data each March evaluating the previous year’s federal tax revenue and spending allocations.

When you dig into this data, it’s hard to see a path forward where taxes don’t rise for U.S. savers - particularly higher-net-worth savers.

Here’s why:

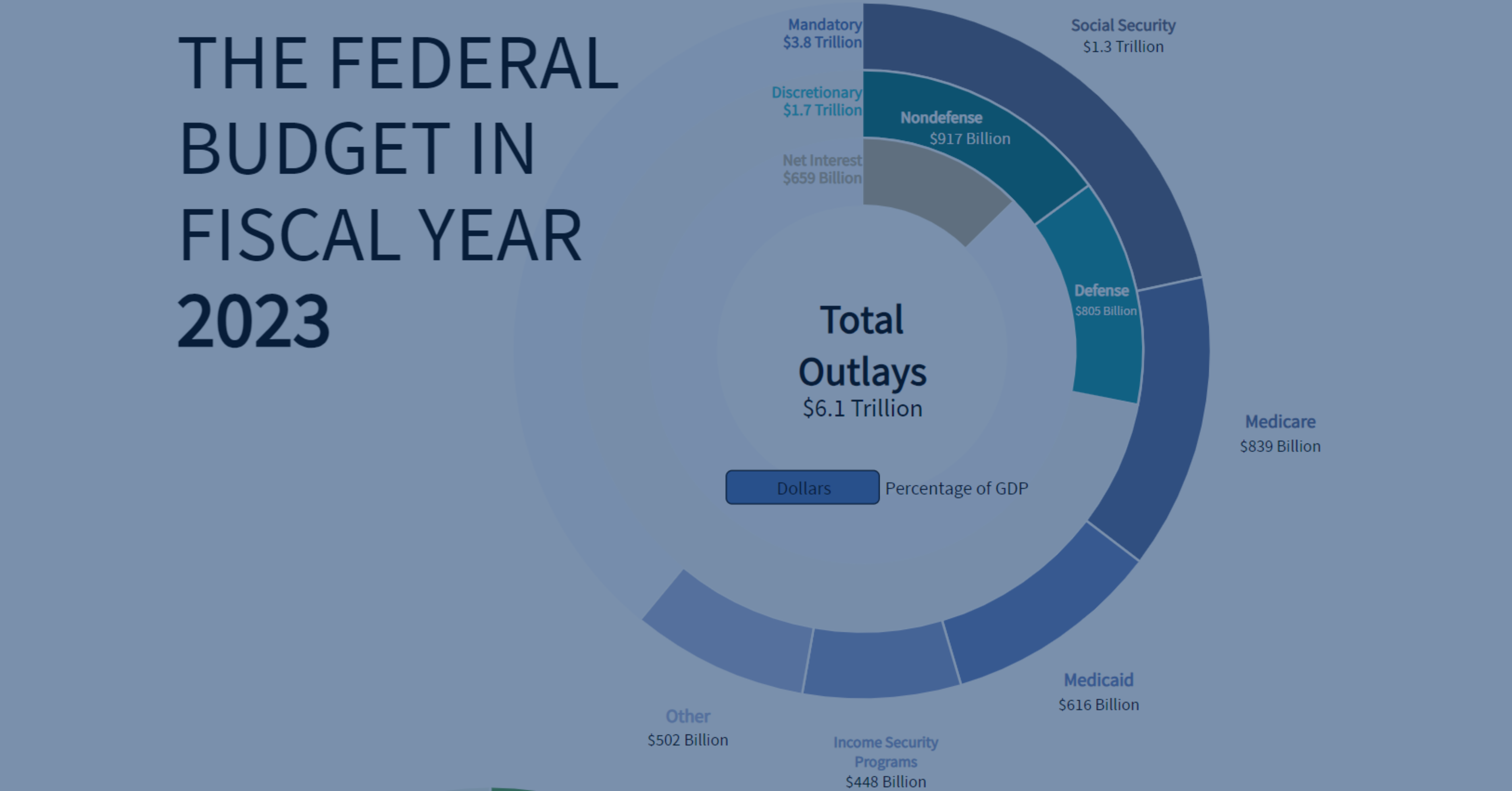

In FY 2022, the federal government took in $4.9 trillion in revenue.

Against that, the federal government allocated $4.1 trillion of mandatory spending. This is spending that Congress and the President do not control. It includes things like Social Security, Medicare, and other government programs required by current law.

The government also allocated $0.5 trillion of service to the federal debt.

So, all in, our government spent about $4.6 trillion on non-discretionary spending.

See the problem?

Our government took in $4.9 trillion in revenue and spent $4.6 trillion - nearly all of it - on mandatory spending requirements.

That means if even Congress never passed a single spending bill, we can barely balance our books as a nation.

Of course, Congress *did* pass spending bills - to the tune of $1.7 trillion in FY 2022. This discretionary spending covered things like our military, federal agencies, and transportation priorities.

But that discretionary spending pushed our already fragile federal budget over the edge.

So, in total, our government took in $4.9 trillion and spent $6.3 trillion.

Anyone who’s taken 3rd-grade math can see the problem: there’s a $1.4 trillion gap between the revenue we bring in and the money we send out.

This is a large part of what’s driven the U.S. debt to a record-high level of $34 trillion.

Fixing the U.S. Spending Problem

The biggest challenge isn’t that our nation spends more than it makes - it’s that it is nearly impossible to change this equation.

Let’s take it piece by piece.

If we want to spend less than we make, there are three places to reduce spending: mandatory programs, like Social Security and Medicare; debt service; or discretionary spending passed by Congress.

Mandatory Spending: In the years ahead, it will be increasingly hard to reign in mandatory spending. After all, the 2020 census showed the fastest growth in U.S. citizens age 65+ in over a century. Further, the Social Security Administration has acknowledged that the program is not sustainable even at current tax and benefit rates. So it’s unlikely we can reduce the amount of money we spend on programs like Social Security and Medicare.

Debt Service: Because we are in a high-interest-rate environment - and because our national debt is growing - our nation is paying more to service our debt than ever before. In 2022, our debt service was $0.5 trillion. In 2023, that rose to $0.9 trillion. Unless we dramatically reduce interest rates or dramatically reduce our debt, this is an area that will continue to grow.

Discretionary Spending: Here’s an area that’s easy to control in theory, but very difficult to reduce in practice. Simply put, Congress could appropriate less money for things like the military, the Department of Education, and other government agencies. However, as we’ve seen in the recent debates to avoid a government shutdown, both House and Senate leaders are not willing to make dramatic cuts in spending. (The negotiated Continuing Resolution (CR) carrying our government through March is $1.66 trillion in spending, a $28 billion increase over last year).

Additionally, we’ve seen Congress spend trillions of dollars in recent years outside of the appropriations process. In 2020, we had the $3.5 trillion economic stimulus bill; in 2021, we had the $1.2 trillion Infrastructure Investment & Jobs Act; and in 2022, we had the $738 billion Inflation Reduction Act.

In short, while from time to time we may have a House, Senate, and White House that can hold down spending temporarily, it’s hard to see a long-term path forward that doesn't include increased spending on both the discretionary and mandatory sides of the ledger.

So What Now?

If the U.S. can’t reduce its mandatory spending, and it won’t reduce its discretionary spending, there’s only one piece of the equation left to adjust:

Increasing revenue.

And what does that mean?

Higher taxes.

The truth is, over the next few decades, what will drive taxes higher for U.S. savers is not just which political party is in power, but how we handle the demographic realities of our nation and the benefits we provide to our citizens.

It’s a math problem, plain and simple.

What Does it Mean for U.S. Savers?

So, what does it all mean for your clients?

If, like the majority of Americans, your clients have large amounts of their retirement savings in tax-deferred accounts - like IRAs and 401(k)s - their taxes could be higher in the future. This could leave them with less retirement income to spend because more of their money is going to the IRS in the form of taxes.

Is that a risk your clients understand? Is that a risk your clients are prepared to address?

As financial professionals, it's our responsibility to help protect our clients against financial risks. And in 2024, tax risk may be the largest, least understood risk facing U.S. savers.

I’m willing to bet most of the savers who attend your seminars, who listen to your radio show, who come into your office - most of them have underestimated the impact a rising tax environment could have on their retirement income.

It’s up to you to uncover, evaluate, and address that risk for them.![]()

If you’re looking for a great lead-gen tool that helps uncover this tax risk for your clients, check out Stonewood Financial’s Retirement Tax Bill program.

In 2024, tax diversification is more important than ever when it comes to your clients’ retirement approaches. This should be a key marketing message and meeting topic for advisors who want to grow their practice and better serve their clients.

Many savers will need to incorporate tax-free assets into their retirement approach to hedge against the risk of rising taxes.

And while you can’t mitigate all the risks of future elections for your clients, tax diversification can help keep them one step ahead of Washington.

So, does the outcome of the 2024 election matter when it comes to your clients and their retirement assets?

Of course, it does.

But with your help, they can be better protected from this election and all the elections that follow. And that will help your client have confidence their retirement is secure - no matter who lives in the White House.

If you’d like to learn more about framing the 2024 election as you prospect and meet with clients this year, check out this recent webinar I hosted on how to leverage the election - without getting political.