Is there a Silent Partner in your Client’s IRA?

I’m a big fan of message frames.

If you’ve ever heard me speak or attended one of Stonewood Financial’s Innovate trainings, you’ve undoubtedly heard me share some of my favorite conversation frames around taxes in retirement.

Message frames are incredibly useful in marketing for financial advisors. They can be molded to fit a seminar room with 100 people or a client meeting with 2.

What’s a message frame?

“Framing” is a common communication technique that targets the audience's attention on a certain aspect of a broad or complex subject. As this Harvard Business Review article notes, framing can “bring clarity to complexity.”

Financial advisors know the power of bringing clarity to complexity. It’s not enough for us to know what’s right for our clients; the clients have to understand it and believe it, too.

And that’s where message frames come in.

How do I leverage message frames?

Within marketing for financial advisors, message frames often serve as stories or narratives around which we can help a client understand risk and how to address it.

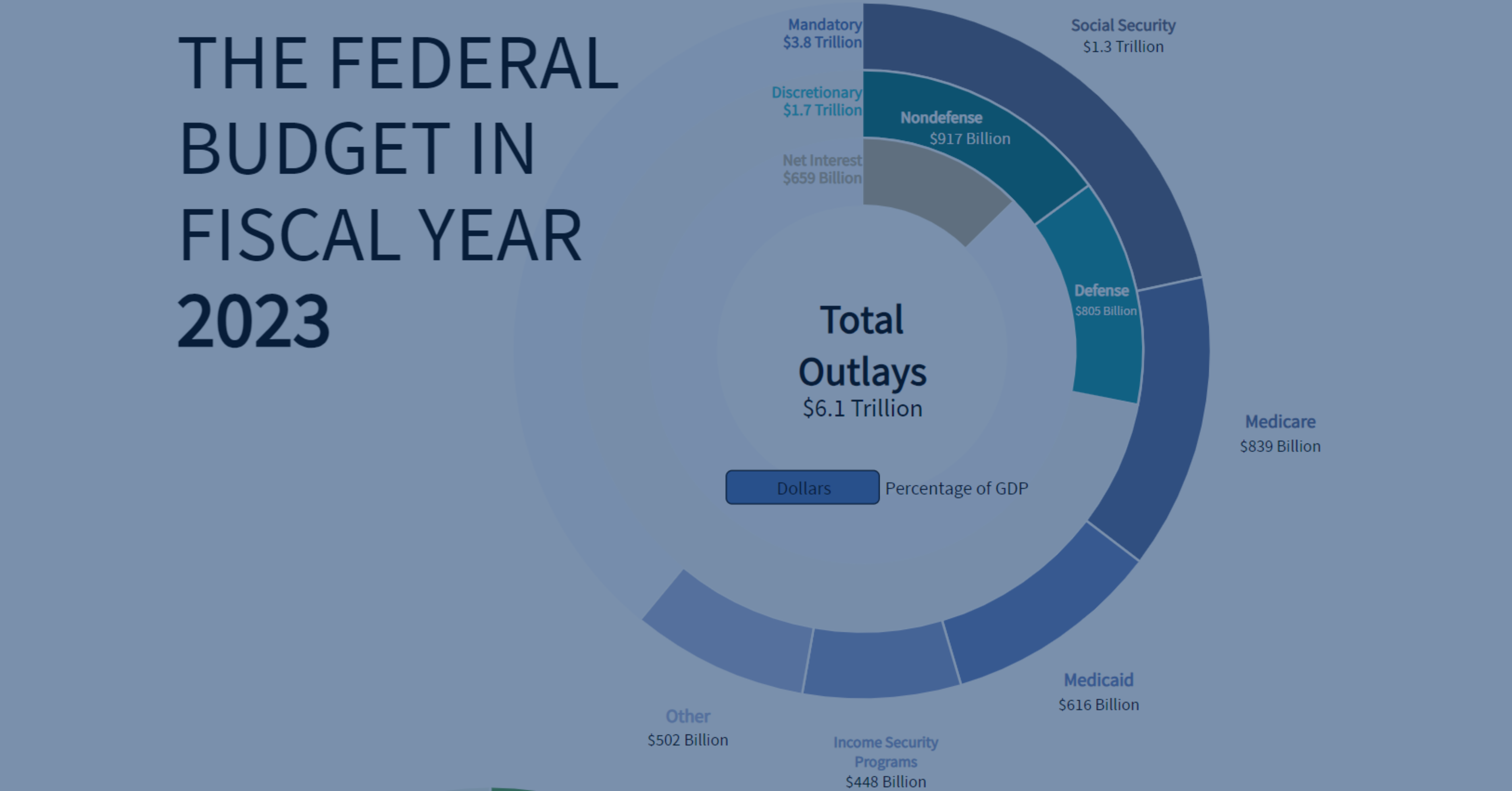

This is especially true when we’re helping clients understand tax risk in retirement. “Taxes” are a broad and complex topic. While many savers understand in theory how rising taxes could impact their retirement income, they don’t really know how to evaluate the impact in practice.

Enter the message frame.

I’ll share one of my favorite message frames on taxes in retirement and then show you how to adapt it to various prospect and client interactions.

Your IRA’s Silent Partner

Do you or someone you know own a small business? I’m a small business owner myself. Running a business can be complicated - and sometimes expensive - so many business owners have a partner.

Let’s say I’m a partner in your small business, and I own 20% of your company.

At the end of each year, as you take a profit from your company, you know you’ll owe me 20% of that profit. After all, I own 20% of your company.

But let’s say next year I come to you and demand 30% of your company’s profit.

What would you say to me?

I suspect you’d say something along the lines of, “Get lost.” “I don’t think so.” Or simply, “No.” Maybe if you were nice, you’d say, “Becky, I know you want 30% of the profits. But you only own 20% of the company. So you’ll get 20% of the profits as planned.”

It’s just common sense.

But here’s something you might not have considered:

If you’ve saved for retirement in a 401(k) IRA, you have a silent partner in your retirement business.

And that partner can change its ownership stake at any time.

That silent partner is the IRS. After all, the IRS gets a piece of every dollar you withdraw from your 401(k) or IRA. They, in a sense, own part of your retirement accounts.

But unlike a small business partner, the IRS can change its ownership at any time by adjusting your tax bracket or tax rate.

And that means this year, the IRS owns 20% of your IRA and next year, legislation gets passed where the IRS owns 30% of your IRA… and there’s nothing you can do about it.

I would never accept a partner in my business who could change his ownership stake without my permission. And I don’t want you to accept that in your retirement approach, either.

Let’s evaluate your current approach and see if there are funds we want to protect from this silent partner and its ever-changing stake in your retirement account.

Putting the Frame to Work

This is one of my favorite frames because it's extremely effective.

In fact, you can listen to me share this message frame on a recent episode of The Complete Advisor podcast.

It takes a complex issue (tax variability as it applies to tax-deferred retirement funds) and brings it clarity by relating the issue to something your client already understands (owning a business).

It can also be used across marketing for financial advisors:

-

In a seminar, workshop, or webinar, as a way to engage the audience and uncover a new risk they hadn’t considered

-

On radio or TV to tell a story that motivates listeners to learn more about tax diversification

-

In email marketing, to grab a reader’s attention

-

As a consumer video on social media or your website to show the kinds of problems you help savers address

-

In your client meetings, to help relate tax diversification to something the client can easily understand

- And on and on

That’s the beauty of message frames. Once you develop a few that you like, you’ll find ways to share them across your client interactions. I’ve used this frame in casual conversations on airplanes and in front of audiences of a thousand people. It always converts because it brings clarity to the complex.

Give this message frame a try, and let me know the kind of response you experience. I’d love to hear your favorite message frames for taxes in retirement, too - connect with me here.