Racing Toward Retirement: Picking the Right Financial Thoroughbreds

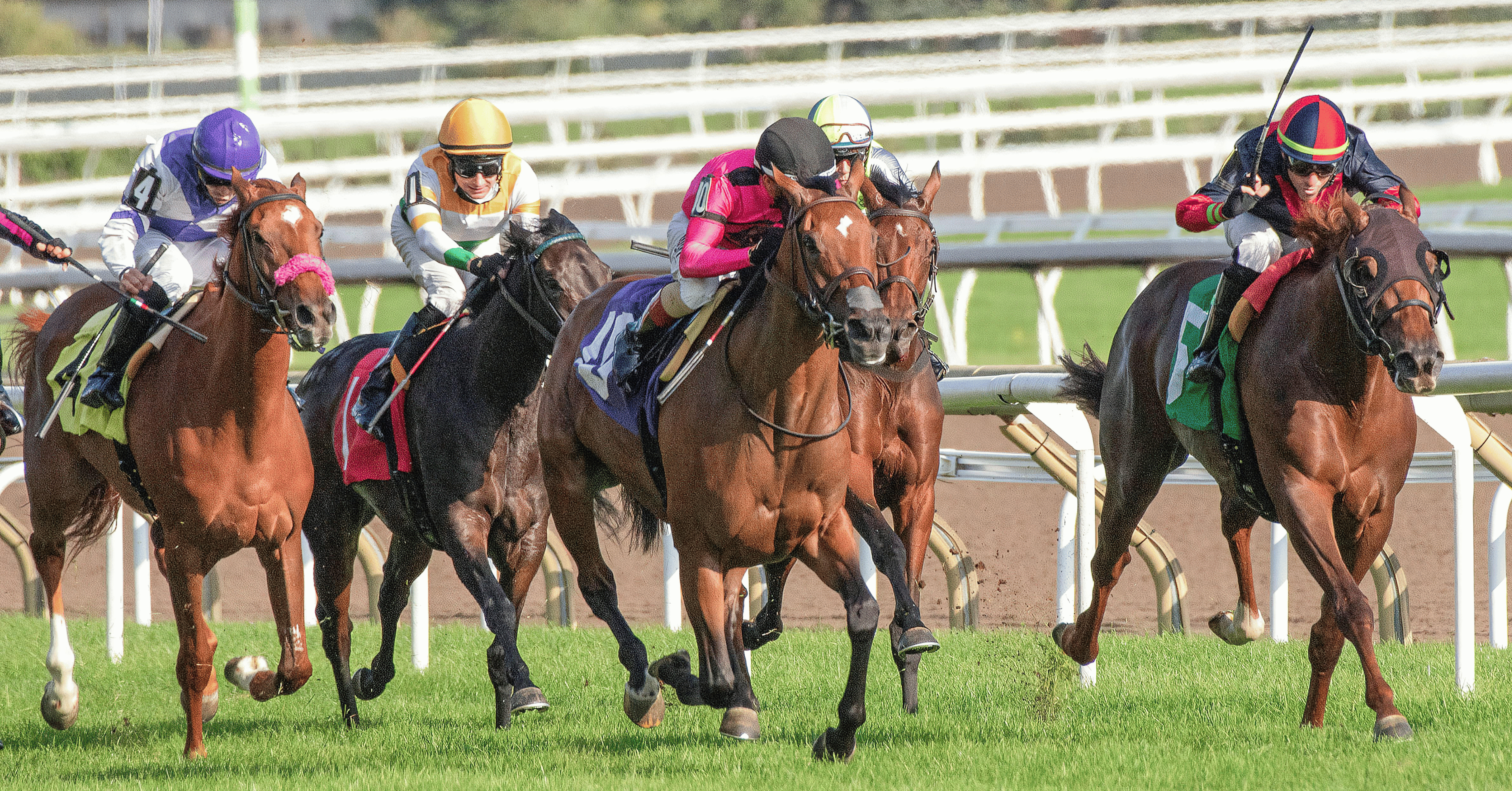

On the eve of the first Saturday in May, all eyes turn to Churchill Downs for "The Most Exciting Two Minutes in Sports." The Kentucky Derby is a celebration of strategy, preparation, and making the right picks — and when it comes to retirement planning, the parallels are clear. Choosing the right retirement saving vehicles is like picking the right horse: you want a strong performer, built to go the distance, and capable of confidently crossing the finish line.

With the retirement landscape evolving faster than ever, financial advisors must guide clients toward savings vehicles that can handle every twist and turn. Here is a look at a few key contenders that, when combined thoughtfully, can create a championship-level retirement plan.

The Thoroughbred: Roth Conversions

A Roth IRA conversion is the thoroughbred of retirement planning. Just like a Derby champion, it requires careful timing and a strong foundation. With tax rates likely to rise in the future, moving assets from traditional IRAs to Roth IRAs allows clients to pay taxes now, locking in today's rates and setting the stage for tax-free income later. Financial advisors who help clients execute smart Roth conversion strategies position them to gallop toward a more secure retirement.

The Steady Workhorse: Annuities

Annuities may not be the flashiest option, but they are the dependable workhorses that can carry clients across the retirement finish line. Fixed indexed annuities, in particular, offer protection from market downturns and the option of lifetime income. In a field full of unpredictable conditions, annuities provide steady footing and peace of mind for clients who want to make sure they win the race of retirement by never running out of money.

The Closer: Life Insurance Strategies

Life insurance is often overlooked as a retirement planning tool, but it can be a powerful asset for the right client. In addition to providing a death benefit, properly structured permanent life insurance policies can offer tax-advantaged growth, tax-free income potential, and legacy planning opportunities. Like a horse that closes fast to win the race, life insurance can provide exceptional value for later-year income needs and - of course - powerful benefits at the finish line.

The Finish Line: Building a Winning Combination

Just as a Derby champion is the result of breeding, training, and strategy, a successful retirement plan relies on blending multiple saving vehicles to create a resilient financial future. No single horse wins every race. It takes a combination of speed, endurance, and smart management to navigate the long track to retirement security and avoid the most pressing risks.

Financial advisors who can guide clients in selecting and balancing the right vehicles will not only help them "place their bets" wisely but also ensure they cross the retirement finish line with a winning approach — and a legacy worth celebrating.

As the call to post rings out this Derby season, it is a good reminder that early preparation and smart picks make all the difference. Help your clients line up their best options now, so they can enjoy the victory lap later.

Ready to help your clients build a retirement plan that is built to win? Connect with Stonewood Financial and access the tools, training, and support you need to lead them to the winner's circle.

.png)

.png)