The Nation’s Fiscal Outlook Just Got Worse. That’s Bad News for Your Client’s Retirement.

Reading over the Congressional Budget Office (CBO) report on FY2023 revenue and spending, I couldn’t help but think of the classic Mad Men quote.

The state of our nation’s finances is… not great.

Let me step back.

Federal spending should be important to every financial advisor who cares about taxation for their clients.

Why?

If your clients have saved a majority of their retirement assets in tax-deferred vehicles like the immensely popular 401(k)s and IRAs, they owe income taxes on those funds in retirement. Individual income taxes make up the majority of federal revenue. If our government spending is up, it needs more revenue to offset it, and that could impact your client’s taxes in retirement.

Each year, the Congressional Budget Office publishes data on the previous fiscal year’s revenue and spending for the U.S. government.

In past years, the outlook has been concerning.

But something significant happened last year that made the situation increasingly dire.

First, let’s look at the numbers.

The State of U.S. Revenue & Spending

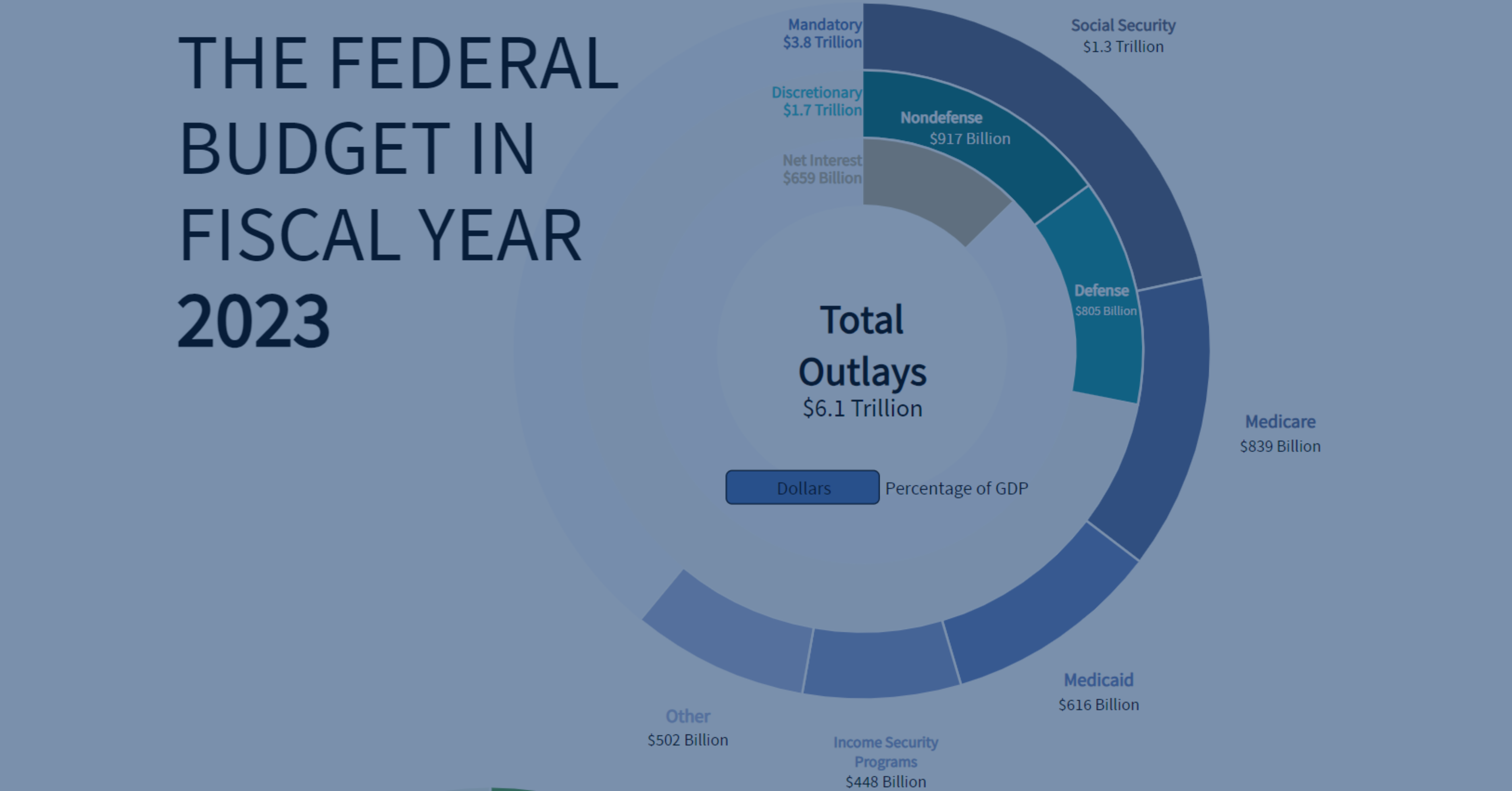

In FY 2023, the government took in about $4.4 trillion in revenue, more than half of which came from individual income taxes.

Now, $4.4 trillion is a lot of revenue.

Unless, of course, our government spent more than $4.4 trillion.

On the spending side of the ledger, things start to get very interesting.

There are two primary forms of government spending: discretionary and non-discretionary (sometimes called mandatory).

Discretionary spending is the spending passed by Congress each year. This includes both the spending Congress passes through appropriation bills (to fund things like national defense and transportation infrastructure) and any supplemental spending Congress passes under other spending bills, like the Inflation Reduction Act or the CARES Act.

Non-discretionary, or mandatory, spending is the spending our government outlays each year outside of the legislative process. Mandatory spending covers all the entitlements our government owes to its citizens based on current law, such as Social Security payments and Medicare benefits. It also includes any other spending that is required under current law.

Why does this matter?

I know you didn’t read this blog post to learn how a bill becomes a law.

But the different spending categories matter a lot when it comes to our nation’s fiscal health.

Back to the CBO numbers.

In FY2023, the federal government spent $3.8 trillion on mandatory spending, primarily through Social Security, Medicare, and Medicaid.

Additionally, the government spent another $600 billion on net interest for the U.S. debt.

Which means in total, our government spent about $4.4 trillion on non-discretionary spending.

Let me put a sharper point on that number.

In FY 2023, the government took in $4.4 trillion in revenue.

And before Congress even gaveled in a session to spend a single dollar, our government had already allocated ALL of those funds to mandatory spending needs.

ALL of them.

Which wouldn’t be a problem if Congress didn’t pass any additional spending. But, of course, Congress did.

In FY2023, Congress appropriated about $1.7 trillion in spending.

Which means our total government outlays were around $6.1 trillion.

Now, I’m going to assume we’ve all taken elementary school math and understand addition and subtraction.

If our government generates $4.4 trillion in revenue and spends $6.1 trillion, there is a $1.7 trillion gap.

This deficit, which occurs year after year, is part of what has driven our federal debt to a record high of $34+ trillion.

This is not sustainable in the long run. And the solution could impact your clients.

The Impact to YOUR Clients

So long term, why does a growing federal deficit lead to higher taxes for our clients?

Our government is facing a big problem and really only has three options to solve it.

To close the trillion-dollar gap each year between revenue and spending, the government has to significantly affect one or more parts of the equation.

First, the government could reduce mandatory spending.

But this is extremely challenging based on current and future U.S. demographics. In fact, our mandatory spending challenges are primarily based on math, not politics.

If you remember, two of the largest mandatory spending categories are Social Security and Medicare. And America has an aging population.

The growth in Americans age 65+ rose between the 2010 census and the 2020 census at the fastest rate since the 1890s. More than $2 trillion of mandatory spending is used for Social Security and Medicare alone. So with more seniors requiring more benefits - and the politically distasteful option of cutting benefits unlikely - this is a hard area of spending for our government to rein in.

Second, the government could reduce discretionary spending. After all, Congress could just quit passing legislation that is so expensive to enact.

I can sense you laughing at your desk as you read that last line. In the past few years, we have seen Congress debate trillions of dollars in NEW spending - not discuss measures to reduce spending.

What’s more, as a nation, we will always need a certain level of discretionary spending. We need to provide for the defense of our country. We need to build new roads and bridges. We want to keep our national parks open to visitors.

Here’s the rub: If we can’t reduce mandatory spending, and it’s unlikely we can significantly reduce discretionary funding, what’s left to balance our finances?

Raising more revenue.

When I evaluate the current fiscal state of our nation, it’s hard to see a path forward without increased revenue being part of the solution.

And that’s why I believe we are entering into a rising tax environment for American savers.

Maybe not this year. Maybe not even next year. But over the years to come, it seems unavoidable.

As a reminder, your clients don’t plan to retire for the next three or four years alone. A big part of our job as advisors is to help clients plan for the totality of retirement. And that means we need to help them protect against rising taxes for 10, 20, 30, or even 40 years to come.

Give your clients information to make informed decisions

If your clients have primarily focused on income planning for retirement, they’ve only done half the work. It’s time to complete their retirement approach with tax planning, too.

After all, income planning is about how much money they’ll have in retirement. Tax planning is about how much of that income they’ll get to keep and spend.

As we head into the 2024 election and beyond, tax diversification will be a critical part of many savers’ retirement approaches. Given the risk of rising taxes in the years to come, it’s increasingly important for many Americans—especially higher-net-worth ones—to diversify the tax status of their retirement assets.

And that means for any of your clients who have all or the majority of their retirement savings in tax-deferred vehicles, 2024 is THE YEAR to get the conversation started.

So where to start?

One of my favorite Stonewood reports can help your clients evaluate their potential Retirement Tax Bill, and look at options to reduce it. You can request a free report for a client of your choice here. And if you want, you can spend some time with my team talking about the top-converting retirement tax strategies for prospecting and client meetings.

One thing is for sure:

Your clients can’t count on the federal government to keep their taxes low in retirement. They need to do it themselves.