The Wealth & Longevity Connection

“How long does my money have to last?”

Every financial advisor has been asked this question. In fact, it’s one of the most common questions retirement advisors hear.

Alas, none of us has a magic ball and can predict the future for our clients.

So, instead, we’ve become experts in helping clients develop income plans that address the risk of outliving their assets.

But are we helping them plan for long enough?

Emerging research says… maybe not.

The Impact of Wealth on Longevity

Does your client know he’s likely to live longer simply because he did a good job saving for retirement?

Okay, that’s a slight oversimplification.

But there is truth in that statement.

A study in the Journal of the American Medical Association (JAMA) shed some light on this topic. Titled “The Association Between Income and Life Expectancy in the United States,” it looked at life expectancies at different income levels.

The study was important enough to be housed at the National Institute of Health’s U.S. National Library of Medicine.

I mention that not to impress you with my knowledge of obscure U.S. government offices, but because when the Library of Medicine catalogs a study, it includes a brief online summary of that study’s importance.

And for this study, that summary was:

“The relationship between income and mortality is well established but remains poorly understood.”

Basically, the NIH is saying: We know wealthier people live longer. But wealthier people don’t understand that they live longer, so they’re not planning for it. And that’s a problem.

This summary should be a wake-up call for our clients.

As financial advisors, we usually see wealthier clients - clients who have saved well for retirement and need help managing those savings.

But if our clients are looking at average life expectancies and trying to plan their retirement income to match it, there’s a good chance their income plans will fail.

And that’s where we can bring unique insight and guidance as advisors.

Longer, but how much longer?

If wealthier Americans are likely to live longer, the next question is obviously: How much longer?

Let’s look at an average saver, age 50.

If that saver is male, his life expectancy is 78.0 years.

But if that same saver is in the top 1% of earners (here in Kentucky, that’s earning about $450k), his life expectancy is much higher - 87.3 years.

Simply by being wealthy, he increased his life expectancy by nearly 10 years.

Logically, this makes sense. On average, wealthier Americans have better access to health care and a higher ability to pay for resources that contribute to a healthy lifestyle.

But many wealthier savers don’t understand the connection between their wealth and how long they might live.

(If you’re curious, the jump for women is similar: 81.9 years for the average 50-year-old woman, but 88.9 years for a 50-year-old woman in the top 1%.)

But wait, there's more!

Research shows that wealthier Americans live longer than the average American.

So does that mean you should help your clients prepare for that longer life expectancy?

Yes… and no.

Yes - because it’s important to create an income plan that lasts longer for your clients.

No - because life expectancy shouldn't be the planning goal.

Here’s a hard truth: Even if you craft income plans for your clients that cover them through their heightened life expectancy, your plans will still fail 50% of the time.

50% of the time!

That’s because life expectancy is an average - and 50% of people, by definition, outlive the average.

Instead, you may want to look at life span when crafting income plans.

What’s the difference?

Life expectancy is the average number of years a member of a given population lives.

Life span is the greatest age reached by any member of a given population.

By focusing on life span, we are helping our clients generate income to an age when it's likely most people like them will no longer be living. And that’s a better measure for ensuring they don’t outlive their income.

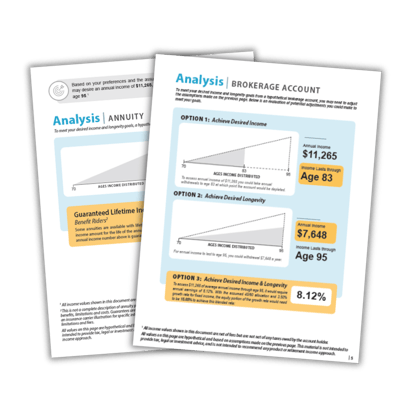

Here at Stonewood Financial, we tend to model all of our income and tax analyses at minimum to age 95.

As advisors, we know there are many tools to help ensure a saver’s income lasts as long as they do. (Check out Stonewood Financial’s new Annuity Alpha software for a great way to demonstrate the power of lifetime income to your clients.)

As advisors, we know there are many tools to help ensure a saver’s income lasts as long as they do. (Check out Stonewood Financial’s new Annuity Alpha software for a great way to demonstrate the power of lifetime income to your clients.)

As we build income plans for our clients, let’s make sure we’re educating these savers on how long they’re likely to live - and how to prepare their assets for what could be a very long ride.

.png)